Some Known Incorrect Statements About Pvm Accounting

Wiki Article

The 45-Second Trick For Pvm Accounting

Table of ContentsLittle Known Questions About Pvm Accounting.Getting My Pvm Accounting To WorkThe 7-Minute Rule for Pvm AccountingThings about Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.The Best Strategy To Use For Pvm Accounting

Look after and take care of the production and approval of all project-related billings to consumers to cultivate good communication and stay clear of concerns. Clean-up accounting. Make certain that proper reports and documents are sent to and are upgraded with the IRS. Ensure that the bookkeeping procedure follows the legislation. Apply called for construction accountancy criteria and treatments to the recording and coverage of building task.Understand and preserve conventional price codes in the bookkeeping system. Communicate with different financing agencies (i.e. Title Company, Escrow Business) regarding the pay application process and needs needed for repayment. Take care of lien waiver disbursement and collection - https://triberr.com/pvmaccount1ng. Monitor and solve financial institution issues including cost anomalies and examine differences. Aid with carrying out and maintaining internal monetary controls and treatments.

The above statements are intended to define the basic nature and level of work being carried out by individuals appointed to this category. They are not to be understood as an exhaustive list of duties, tasks, and skills called for. Personnel might be needed to carry out duties beyond their regular obligations from time to time, as required.

Some Known Incorrect Statements About Pvm Accounting

Accel is seeking a Building and construction Accountant for the Chicago Office. The Construction Accounting professional carries out a selection of accounting, insurance coverage conformity, and task management.Principal responsibilities consist of, yet are not limited to, managing all accounting features of the company in a timely and exact fashion and providing records and schedules to the business's certified public accountant Company in the prep work of all financial statements. Guarantees that all accountancy treatments and functions are handled properly. In charge of all economic records, payroll, financial and daily operation of the audit function.

Prepares bi-weekly trial equilibrium reports. Works with Job Supervisors to prepare and post all regular monthly billings. Processes and problems all accounts payable and subcontractor settlements. Creates monthly wrap-ups for Employees Payment and General Obligation insurance policy costs. Generates monthly Task Price to Date records and dealing with PMs to fix up with Project Supervisors' allocate each task.

Top Guidelines Of Pvm Accounting

Efficiency in Sage 300 Building and Realty (formerly Sage Timberline Workplace) and Procore building and construction monitoring software an and also. https://www.figma.com/design/pEGqwVkdxaWH6r5PgQiEyD/Untitled?node-id=0%3A1&t=BbE3XCPdNiLo7e15-1. Have to likewise be competent in various other computer software application systems for the prep work of reports, spread sheets and various other bookkeeping this article evaluation that might be required by administration. Clean-up accounting. Should have strong business abilities and capability to prioritizeThey are the financial custodians who guarantee that building and construction projects remain on budget plan, conform with tax policies, and preserve economic openness. Construction accountants are not just number crunchers; they are calculated partners in the building process. Their main duty is to take care of the economic aspects of construction projects, guaranteeing that sources are alloted efficiently and financial dangers are lessened.

Rumored Buzz on Pvm Accounting

They work very closely with task managers to produce and keep track of budgets, track expenditures, and projection economic requirements. By keeping a tight grasp on job funds, accountants aid stop overspending and economic problems. Budgeting is a cornerstone of successful construction jobs, and building accounting professionals are crucial hereof. They produce in-depth budgets that encompass all task costs, from materials and labor to licenses and insurance coverage.Navigating the facility web of tax obligation regulations in the building industry can be difficult. Construction accounting professionals are well-versed in these laws and guarantee that the task follows all tax needs. This consists of handling payroll tax obligations, sales taxes, and any kind of various other tax obligations details to building and construction. To master the duty of a building accountant, people require a solid academic structure in bookkeeping and money.

Additionally, certifications such as Qualified Public Accounting Professional (CPA) or Certified Construction Sector Financial Expert (CCIFP) are extremely concerned in the industry. Construction projects commonly include limited due dates, altering guidelines, and unanticipated expenditures.

A Biased View of Pvm Accounting

Ans: Building accountants produce and keep track of spending plans, determining cost-saving opportunities and making certain that the job remains within spending plan. Ans: Yes, building accountants take care of tax compliance for construction tasks.

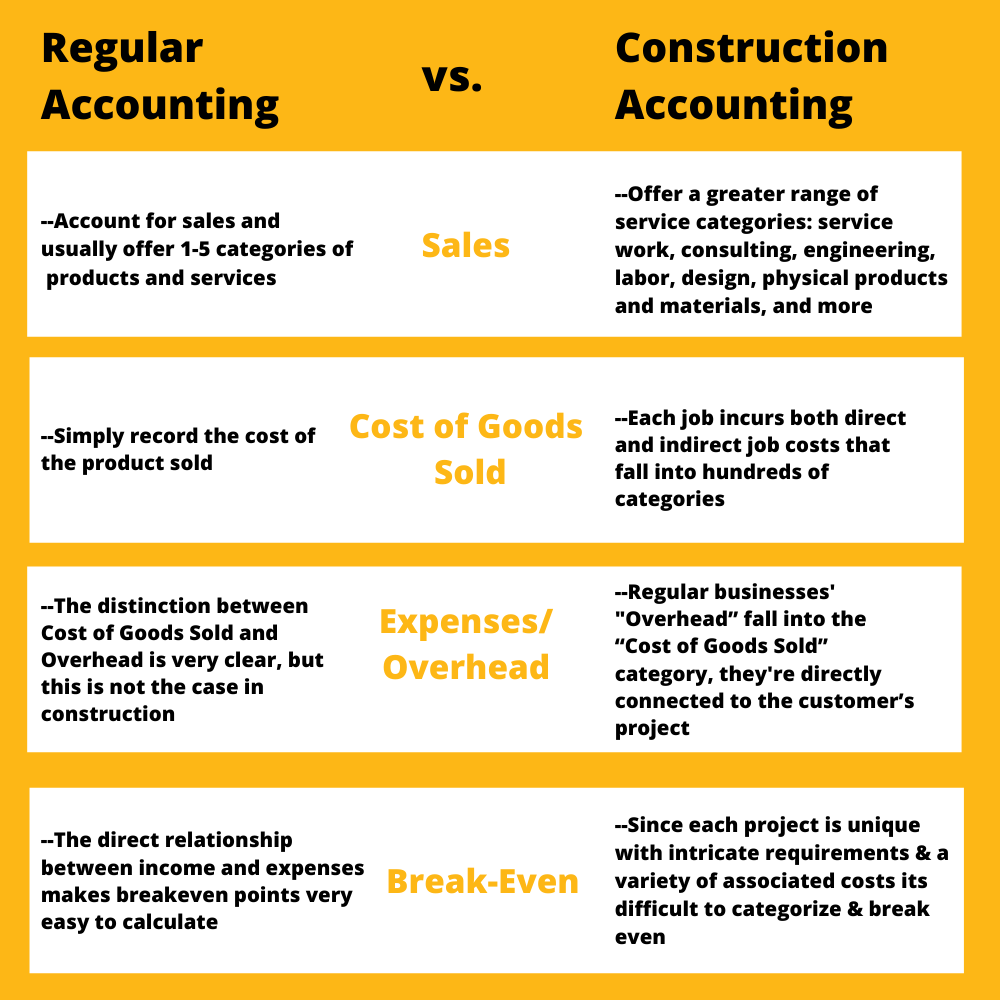

Intro to Building Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make hard choices amongst many economic options, like bidding process on one job over one more, selecting funding for materials or devices, or establishing a job's earnings margin. On top of that, building and construction is a notoriously unpredictable industry with a high failing rate, slow-moving time to repayment, and irregular capital.

Production entails repeated processes with easily identifiable prices. Production needs various processes, products, and equipment with varying prices. Each job takes area in a new area with varying website conditions and unique obstacles.

Facts About Pvm Accounting Uncovered

Frequent use of various specialized specialists and vendors impacts effectiveness and cash flow. Repayment gets here in full or with regular payments for the complete contract amount. Some section of repayment may be held back up until project conclusion even when the contractor's job is completed.Regular manufacturing and short-term contracts result in manageable capital cycles. Irregular. Retainage, slow-moving repayments, and high upfront prices cause long, irregular capital cycles - Clean-up bookkeeping. While conventional manufacturers have the advantage of controlled environments and maximized production procedures, building and construction business must frequently adapt to each brand-new project. Also somewhat repeatable tasks need modifications because of site problems and other variables.

Report this wiki page